For most of our marriage, my husband and I followed a strict rule: Whatever gets charged to the credit card gets paid off at the end of the month. But when years of underemployment and big medical bills caught up with us, we broke that rule. And as it goes with credit cards, our debt rose faster than we could pay it off.

We learned a hard lesson in those years about the pressure of debt, and the determination it takes to get rid of it. As many graduate students or homeowners know, owing money is a burden that can weigh heavily on all areas of your life — especially if it grows so large, or lasts for such a long time, that you begin to feel like it’s impossible to overcome.

Now let’s work on the strategy part, because even when you’re ready to roll up your sleeves and pinch some pennies, it can be really difficult to know where to start. What debts should you pay off first and how much should you aim to pay off each month?

Some experts suggest paying off the card with the highest interest rate first (and, to be sure, the math is kinder this way), but, according to research from the Harvard Business Review, you should actually start with the smallest owed balance first, not the biggest or the one with the most interest.

This strategy for paying off credit card debt is something experts are now calling “The Snowball Effect” and it’s similar in theory to the way you might approach weight loss: Slow and steady, with reasonable goals and expectations. The idea is that if you start off by successfully eliminating small chunks of debt, you’ll see progress almost immediately, and that feeling of success will motivate you to keep paying down your debt consistently over time — and you’ll need to hang in there if you want to accomplish the feat of being debt-free.

Trust me: paying off any debt feels terrific. Even the tiny ones. Because, even if the payment was just $100, it feels like you were able to wipe a part of the slate clean, like red marker from a white board. Picture yourself physically wiping those red numbers away. It’s satisfying, right? And once you discover that paying off a debt not only feels good, but is possible, you’ll be more motivated to keep paying off larger and larger balances.

So now that you understand the logic behind the Snowball Effect, it’s time to take a closer look at how it works, and put it into practice. Here are a few of the main points:

Focus on the card with the lowest balance. Unless you’re able to consolidate debt onto one credit card at a lower rate, resist the temptation to consolidate debt. Instead, ignore interest rates and focus only on the card with the lowest balance.

Pay just a tiny bit extra than you need to. Figure out how much more than the minimum rate you can afford to pay down each month on that one card. And then make it happen. Even if that means taking on more work or considering an extra job to pay more of it down.

Keep the momentum up. Just like a snowball rolling down the hill, don’t stop when that one card you chose to focus on is paid down. Take the same amount of money you were allocating toward paying that first card, and start using it to pay your second smallest debt. And when you’ve erased that debt? Move on to the third smallest. You get the idea!

But in order to employ this strategy, it’s a good idea to get organized and create an outline for yourself of how much and when you’re going to pay off those debts, from smallest to largest.

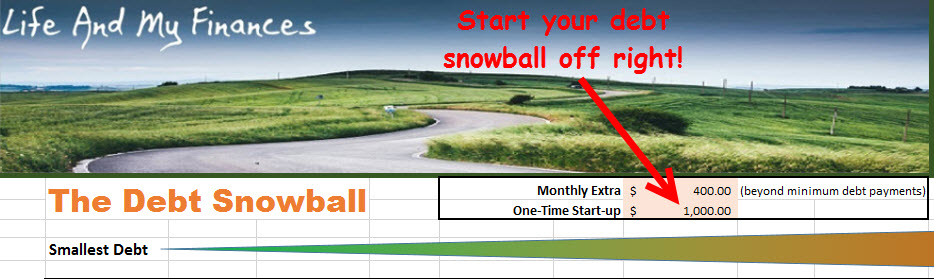

And there are online tools that can help you with this step. For example, Derek Sall, a finance blogger and book author who lives debt-free after having successfully paid off more than $54,000 in debt, created a debt repayment spreadsheet tool, specifically for people who want to use the snowballing strategy (and free for anyone to download on his website). The spreadsheet (the very beginnings of which are seen above) allows users to track their repayment and calculate exactly how long paying off your debts will take.

The neatly organized template (which has a lot of the tough stuff figured out for you already) also has a step-by-step guide, so you can start plugging in numbers as soon as you have it open on your computer. Being able to track your progress efficiently like this will be incredibly motivating, so refer to it often and update it as needed. Pretty soon, as you pay down more and more debts, you’ll find yourself working harder toward meeting each new goal. Because, sure, paying off credit cards isn’t the most fun thing in the world (it’s right down there with cleaning the bathroom and other unpleasant chores), but being able to track your success in small bite-sized goals will make it a lot less painful.

Read more:

What are you willing to go into debt for?